Annuity Present Value

Results

Present Value(Payment at Beginning):$8,832.10

Please note that the total payment over years is $12,000.00 and the total discount is -$3,167.90

Description

This Present Value of Annuity calculator helps you to calculat e the value of a series of equal cash flows over a given date. You can use this calculator to compute the present value of a series of periodic payments to be received or made at some point in the future. The most common uses for the Present Value of Annuity Calculator include calculating the cash value of a court settlement, retirement funding needs, or loan payments.

What is an Annuity

An annuity is a specialized financial arrangement involving a sequence of payments over a designated timeframe, regardless of the money's direction (incoming or outgoing). Annuities need to fulfill two conditions: the payments being uniform and occurring at regular intervals. For instance, $500 payments made at the end of each year of the upcoming ten years constitutes a 10 - year annuity.

Annuity Types

Annuities can be cla ssified in a variety of ways such as contingent annuity, guaranteed annuity, fixed annuities, variable annuities, and equity - indexed annuities. From the perspective of this annuity calculator, we differentiate annuities in terms the timing of the payments. There are two types of annuities:

Ordinary Annuity:

Payments are made at the end of the periods. Example of ordinary annuity are mortgages, car loans, and student loans.

Annuity due:

Payments are made at the beginning of each period. Example of annuity due are rental lease payments, life/health insurance premium, and lottery payoffs.

Formula to calculate present value of an annuity

The two basic annuity formulas are as follows:

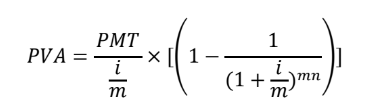

PV of Ordinary Annuity

Where, PMT = periodic payment; i = annual interest rate; n = number of years; m = number of period in a year. For example, m=1 for annually; m=365 for daily; m=2 for semi - annually; m=4 for quarterly; m=12 for monthly.

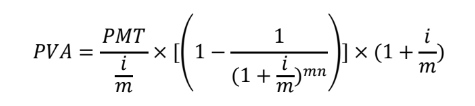

Where, PMT = periodic payment; i = annual interest rate; n = number of years; m = number of period in a year. For example, m=1 for annually; m=365 for daily; m=2 for semi - annually; m=4 for quarterly; m=12 for monthly.PV of Annuity due

Where, PMT = periodic payment; i = annual interest rate; n = number of years; m = number of period in a year. For example, m=1 for annually; m=365 for daily; m=2 for semi - annually; m=4 for quarterly; m=12 for monthly.

Where, PMT = periodic payment; i = annual interest rate; n = number of years; m = number of period in a year. For example, m=1 for annually; m=365 for daily; m=2 for semi - annually; m=4 for quarterly; m=12 for monthly.How to use this annuity calculator ?

Lets assume that you are to receive $ 1,200 by the end of every year for 10 years into the future. The discount rate is 6 % compounded every year. Now you want to know the present value of all the money that you are going to receive in the future. Here is how you can use this calculator.

Periodic Payment Amount:

Enter $1,200 as your periodic payment amount. For example, a yearly payment of $1,200 will be $300 when paid quarterly. Your input should be greater than 0.

Payment Interval:

Select Annually if payment is made only once a year. Select daily if payment is made daily, and etc. This will be used as the basis of interest compounding.

Payment at.. :

Select end (ordinary) if you make payment at the end of the period. Select beginning (due) if you make payment at the beginning of the period.

Annual Interest Rate:

Enter an annual interest rate of 6% if you think your account will earn interests at 6% annually. You are allowed to enter a minimum value of 0%.

Number of Years:

Enter 10 if you think you are going receive/pay an equal amount for 10 years in a row. In other words, this is your annuity duration. Your entered number has to be greater than 0.

Once you entered all the numbers as stated above, click on “Calculate” button. The calculator will show the present value of the annuity as $8,832.10. The total payment is $12,000.00 and the total discount is - $3,167.90.