Internal Rate of Return Calculator

Results

Internal Rate of Return = 0%

| Period | Amount | Discount Rate | PV of CFs |

|---|

What is Internal Rate of Return?

The internal rate of return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. IRR is a discount rate that makes the net present value (NPV) of all cash flows of an investment equal to zero in a discounted cash flo w analysis. Generally, the higher an internal rate of return, the more desirable an investment is to undertake.

How to Calculate Internal Rate of Return?

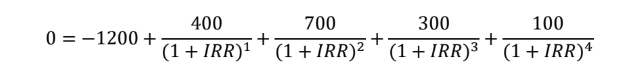

IRR calculations rely on the same formula as NPV does. Keep in mind that IRR is not the actual dollar value of the project. It is the annual return that makes the NPV equal to zero. The formula to calculate internal rate of return is: Where:

Where:

Ct = Net cash inflow during the period t

IRR = The internal rate of return

t = The number of time periods

Suppose that you are going to invest $1,200 and receive a 4 yearly cashflows of $400, $700, $300, and $100. You might one to know the discount rate that will make the net present value of your investment equal to 0. Here is the mathematical equation of the problem, in which we will solve for IRR.

In the equation above, we need to solve for IRR, which is the only unknown.

How to use Internal Rate of Return Calculator?

Let’s assume that you have an investment opportunity that requires you to invest $ 1,200 that will give you 4 different cash in flows. If you like to know the discount rate or IRR that makes the investment’s NPV equal to Zero, make the following entries in our calculator.

Initial Investment:

This number is by default a negative number. What it means is that investment into the project is always a cash outflow (negative number) from you. In finance, investment is always defined as a negative number. You need to enter your initial investment amount as $1,200.

Number of Cash Flows:

From the dropdown box, select how many yearly cash flows input boxes you want for your project. Let’s assume that your investment has 4 cash in flows. Therefore, select, 4 from the list.

Cash Flows :

Depending on the number of cash flow input boxes you selected, you need to enter all cash flows. For example, for your investment, enter $400, $700, $300 and $100.

Once you have entered all the numbers as stated above, click on “Calculate” button. The calculator will show you the internal rate of return of 11.636%. This means that your investment will have a NPV of 0 if you discount all the future cashflows at the rate of 11.636%. The breakdown of the NPV calculation is given in the results table where in the sum of the present value of CFs is equal to 0.