Rule of 72 Calculator

Results

Number of years required to double your investment at 7% is 10.286 Years. However, the exact answer to double your investment is 10.245 Years.

| Year | Beginning Investment Balance | Interest | End Investment Balance |

|---|---|---|---|

| 0 | $0.00 | $0.00 | $0.00 |

What is Rule of 72?

The Rule of 72 is a quick and simple formula used to estimate the time it takes for an investment to double in value at a given interest rate. To calculate the approximate doubling time, divide 72 by the annual interest rate. For instance, with an interest rate of 8%, it would take approximately 9 years for an investment to double (72 divided by 8 equals 9).Where is it Used?

Suppose that you do not have access to time value of money tables or financial calculator but want to know how long it takes for your money to double. The easy was to approximate this is to use rule of 72. The Rule of 72 finds its application across various financial contexts, i ncluding debts, investments, savings accounts, and retirement planning. It serves as a valuable tool for making quick estimations and gaining insights into the potential growth of investments over time.Benefits of using it

Using the Rule of 72 offers seve ral benefits. Firstly, it provides a straightforward method for estimating the doubling time of investments, allowing individuals to set realistic financial goals. Additionally, it aids in decision - making by helping investors compare different investment o ptions based on their expected growth rates. Moreover, its simplicity makes it accessible to people of all financial backgrounds, empowering them to make informed decisions about their financial future with ease.Formula of Rule of 72

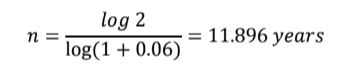

For instance, with an interest rate of 6 % and an initial investment amount of $3,500 , it would take approximately 12 years for an investment to double (72 divided by 6 equals 12 ). However, this answer is an approximation. To know the precise number of years, we need to apply the time value of money formula as given below:3500 X 2 = 3500 X (1+0.06)n

We need to back calculate the n from the above equation. We can also shorten the formula in a logarithmic form for easy calculation as below: